By Naomi Kresge - Wed Feb 15 11:18:29 GMT 2012

Teva Pharmaceutical Industries Ltd. (TEVA) said fourth-quarter profit rose 23 percent as last year’s acquisition of Cephalon Inc. shifted the company further away from its original identity as a generic-drug maker.

Earnings excluding some costs climbed to $1.4 billion, or $1.59 a share, from $1.1 billion, or $1.25, a year earlier, the Petach Tikva, Israel-based company said in a statement today. Profit matched the average estimate of $1.59 a share from 25 analysts surveyed by Bloomberg.

Teva, the world’s biggest maker of copied medicines, bought Frazer, Pennsylvania-based Cephalon for $6.5 billion last year in a bid to broaden a portfolio of brand-name drugs that has been dominated by the multiple sclerosis treatment Copaxone. In May, Teva will replace Chief Executive Officer Shlomo Yanai with Jeremy Levin, a Bristol-Myers Squibb Co. (BMY) executive known for overseeing the U.S. drugmaker’s “string of pearls” strategy of small acquisitions and partnerships.

“I hope that in May he knows exactly what he wants to do because he doesn’t have time to waste,” Gilad Alper, a Tel Aviv-based analyst for Excellence Nessuah Brokerage, said in a telephone interview today. “Whatever Levin wants to do, he’ll need a lot of money. He needs the goodwill of lenders, and that will decline rather quickly if Copaxone market share declines.”

Pipeline

Teva has a strong pipeline of branded drugs, Yanai said at a press conference in Tel Aviv today. The company is in “advanced talks” with U.S. Food and Drug Administration officials to craft a study to enable it to win approval for multiple sclerosis pill laquinimod, he said. The drug failed in one trial last year and yielded disappointing results in a second.

“I am optimistic about the continued growth of Teva in the branded products sector,” Yanai said.

Earnings excluding some costs this year will be $5.48 to $5.68 a share, while revenue will reach about $22 billion, Teva said in December. The company said then it may not meet its long-term target of $31 billion in sales by 2015, which Yanai described as an “aspirational goal.”

Teva rose 2.4 percent to 167.80 shekels at 1:17 p.m. in Tel Aviv. The company’s American depositary receipts have lost 15 percent in the past year including reinvested dividends on the Nasdaq Stock Market, compared with a 17 percent return for the Bloomberg Europe Pharmaceutical Index.

Narcolepsy

Sales rose 28 percent to $5.7 billion, as revenue from brand-name drugs soared 68 percent to $2.3 billion with the inclusion of Cephalon’s products. Sales of generic drugs in the U.S. fell 5 percent to $1.2 billion.

Cephalon’s top-selling drug, Provigil, loses patent protection in April, Natali Gotlieb, a Tel Aviv-based analyst for Israel Brokerage & Investments Ltd., said in a telephone interview today. The narcolepsy treatment had sales of $350 million in the fourth quarter.

“Everyone already has 2012 in their mind,” Gotlieb said.

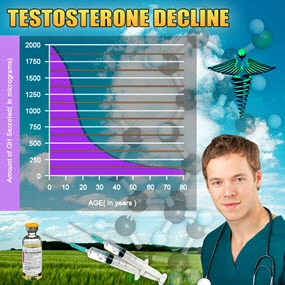

Teva and U.S. partner BioSante Pharmaceuticals Inc. (BPAX) won U.S. clearance to sell Bio-T-Gel, a testosterone replacement therapy for men, the Food and Drug Administration said late yesterday. BioSante estimates the U.S. market for male testosterone products exceeds $1.2 billion.

Copaxone Peak

Fourth-quarter revenue from Copaxone, which faces competition from newer treatments, increased 11 percent to $927 million. Teva has said sales will probably peak at $3.8 billion this year.

The company reported profit that doesn’t meet generally accepted accounting principles because it excludes costs linked to acquisitions such as Cephalon. On a net income basis, Teva earned $506 million in the quarter, 34 percent less than the $771 million in the year-ago period.

Teva increased its quarterly dividend 25 percent to 1 shekel a share. The company will hold a conference call with analysts at 8:30 a.m. New York time today.

To contact the reporter on this story: Naomi Kresge in Berlin at nkresge@bloomberg.net

To contact the editor responsible for this story: Phil Serafino at pserafino@bloomberg.net

See the original post:

Teva Fourth-Quarter Profit Rises on Cephalon Purchase

Contact Us Today For A Free Consultation

- Part 2: Effect of Testosterone Replacement Therapy on Prostate Tissue in Men with Late-Onset Hypogonadism (Dramatic Health) [Last Updated On: March 24th, 2018] [Originally Added On: May 7th, 2011]

- Full: Effect of Testosterone Replacement Therapy on Prostate Tissue in Men with Late-Onset Hypogonadism (Dramatic Health) [Last Updated On: May 3rd, 2023] [Originally Added On: May 7th, 2011]

- Testosterone Replacement Therapy (TRT): Optimizing Clinical Outcomes - Michael Aziz, MD [Last Updated On: November 12th, 2023] [Originally Added On: May 8th, 2011]

- Part 1: Effect of Testosterone Replacement Therapy on Prostate Tissue in Men with Late-Onset Hypogonadism (Dramatic Health) [Last Updated On: March 24th, 2018] [Originally Added On: May 8th, 2011]

- Part 4: Effect of Testosterone Replacement Therapy on Prostate Tissue in Men with Late-Onset Hypogonadism (Dramatic Health) [Last Updated On: November 12th, 2023] [Originally Added On: May 30th, 2011]

- Part 3: Effect of Testosterone Replacement Therapy on Prostate Tissue in Men with Late-Onset Hypogonadism (Dramatic Health) [Last Updated On: November 15th, 2023] [Originally Added On: June 2nd, 2011]

- Testosterone Replacement [Last Updated On: November 23rd, 2023] [Originally Added On: June 7th, 2011]

- Medical Professor on Testosterone Replacement Therapy [Last Updated On: November 17th, 2023] [Originally Added On: June 14th, 2011]

- Sean McCorkle Discusses Testosterone Replacement Therapy [Last Updated On: November 18th, 2023] [Originally Added On: July 11th, 2011]

- Use of Testosterone in Men With Prostate Cancer [Last Updated On: November 22nd, 2023] [Originally Added On: September 28th, 2011]

- Low Testosterone (Low T) - Video [Last Updated On: November 25th, 2024] [Originally Added On: December 10th, 2011]

- Transdermal Drug Delivery - Technologies, Markets, and Companies [Last Updated On: April 29th, 2025] [Originally Added On: February 2nd, 2012]

- How Testosterone Replacement Therapy Builds Muscle and Stops Pain [Last Updated On: February 4th, 2024] [Originally Added On: February 4th, 2012]

- Teva, BioSante’s Testosterone Gel for Men Wins Approval From U.S. FDA [Last Updated On: January 11th, 2018] [Originally Added On: February 15th, 2012]

- FDA approves Teva, BioSante testosterone gel [Last Updated On: January 18th, 2018] [Originally Added On: February 15th, 2012]

- Renowned Dr. Oz and the Acclaimed Financial Times Now Have Featured Dr. Lionel Bisson, Founder of ... [Last Updated On: April 27th, 2025] [Originally Added On: February 17th, 2012]

- Omaha man says testosterone replacement therapy changed his life [Last Updated On: December 15th, 2017] [Originally Added On: May 5th, 2012]

- Auxilium Pharmaceuticals, Inc. and GlaxoSmithKline LLC Enter Into a Co-Promotion Agreement for Testim® in the U.S. [Last Updated On: May 6th, 2025] [Originally Added On: May 21st, 2012]

- Hormone therapy results in weight loss [Last Updated On: January 27th, 2018] [Originally Added On: June 25th, 2012]

- Testosterone in Women-Putting Your Sex Drive Bacl On Track - Video [Last Updated On: December 31st, 2024] [Originally Added On: November 2nd, 2012]

- Men's Health PITCH: Testosterone - Video [Last Updated On: January 1st, 2025] [Originally Added On: November 2nd, 2012]

- Dr. Karron Power Appears on Nightline - Testosterone Therapy - Video [Last Updated On: January 1st, 2025] [Originally Added On: November 2nd, 2012]

- Testosterone Replacement Therapy: Who is TRT Best For? - Video [Last Updated On: January 2nd, 2025] [Originally Added On: November 2nd, 2012]

- Female sex-enhancing nasal spray undergoing clinical trials [Last Updated On: October 24th, 2015] [Originally Added On: November 2nd, 2012]

- Andropause: A Diagnosis Whose Time Has Come [Last Updated On: June 3rd, 2025] [Originally Added On: November 16th, 2012]

- Dealing With Mood Disorders During the Holidays (Depression, Anxiety, Depersonalization) - Video [Last Updated On: February 7th, 2025] [Originally Added On: November 26th, 2012]

- Testosterone Roundtable -- Hypergonadism and Testosterone Replacement Therapy (Part 6) - Video [Last Updated On: February 19th, 2025] [Originally Added On: December 10th, 2012]

- Battling my Testosterone Replacement Therapy Doctor, Carpal Tunnel Syndrome, and Weightlifting - Video [Last Updated On: March 12th, 2013] [Originally Added On: March 12th, 2013]

- Low T? Testosterone Replacement Therapy - Video [Last Updated On: March 13th, 2013] [Originally Added On: March 13th, 2013]

- Testosterone Replacement Therapy: Nothing To Be Ashamed Of: Strike First Nutrition - Video [Last Updated On: May 18th, 2013] [Originally Added On: May 18th, 2013]

- Testosterone Replacement Therapy: Symptoms of Low Testosterone - Strike First Nutrition - Video [Last Updated On: May 18th, 2013] [Originally Added On: May 18th, 2013]

- Testosterone Replacement Therapy Testimonial - Video [Last Updated On: June 15th, 2013] [Originally Added On: June 15th, 2013]

- Taurus Male Clinic Testosterone Replacement Therapy - Video [Last Updated On: July 28th, 2013] [Originally Added On: July 28th, 2013]

- Can I Quit TRT Or Testosterone Replacement Therapy? By Low Testosterone Expert Dr David Asher - Video [Last Updated On: March 16th, 2017] [Originally Added On: August 7th, 2013]

- What Are The Side Effects of TRT Testosterone Replacement Therapy? By Low T Expert Dr. David Asher - Video [Last Updated On: August 7th, 2013] [Originally Added On: August 7th, 2013]

- Bill Jones 1513 Testosterone Replacement Therapy Testimonial - Video [Last Updated On: August 8th, 2013] [Originally Added On: August 8th, 2013]

- 2013-08-06 Testosterone Replacement Therapy - Video [Last Updated On: August 10th, 2013] [Originally Added On: August 10th, 2013]

- Testosterone Replacement Therapy West Palm Beach Florida - Video [Last Updated On: August 18th, 2013] [Originally Added On: August 18th, 2013]

- Testosterone Replacement Therapy Testimony from Patient of Body Renew Medical in Lees Summit MO - Video [Last Updated On: September 2nd, 2013] [Originally Added On: September 2nd, 2013]

- FGSW - An Update On My Testosterone Replacement Therapy: Doctor's Visit 09.16.13 - Video [Last Updated On: September 19th, 2013] [Originally Added On: September 19th, 2013]

- Testosterone Replacement Therapy - Testosterone Treatment [Last Updated On: March 25th, 2025] [Originally Added On: October 31st, 2013]

- Testosterone Side Effects from Testosterone Replacement Therapy [Last Updated On: January 11th, 2018] [Originally Added On: November 3rd, 2013]

- FGSW - An Update On My Testosterone Replacement Therapy (TRT) 11.08.13: Getting No Sleep! - Video [Last Updated On: November 14th, 2013] [Originally Added On: November 14th, 2013]

- WebMD: Erectile Dysfunction: Testosterone Replacement Therapy [Last Updated On: December 6th, 2017] [Originally Added On: November 25th, 2013]

- Testosterone Replacement Therapy! Male Hormones! [Last Updated On: January 15th, 2018] [Originally Added On: November 25th, 2013]

- FGSW - Testosterone Replacement Therapy TRT Update: Am I Back Where I Started - 11.25.13 - Video [Last Updated On: November 27th, 2013] [Originally Added On: November 27th, 2013]

- The benefits and risks of testosterone replacement therapy: a ... [Last Updated On: January 12th, 2018] [Originally Added On: December 8th, 2013]

- Testosterone replacement therapy can carry health risks - CBS News [Last Updated On: January 16th, 2018] [Originally Added On: December 8th, 2013]

- Reclaim Your Energy and Sex Drive | Testosterone Replacement ... [Last Updated On: April 6th, 2025] [Originally Added On: December 21st, 2013]

- Low Testosterone Therapy and Treatment - Do You Have Low ... [Last Updated On: October 24th, 2015] [Originally Added On: December 24th, 2013]

- How Long Does it Take for Testosterone Replacement Therapy to ... [Last Updated On: December 30th, 2017] [Originally Added On: January 3rd, 2014]

- Testosterone Therapy - Bioidentical Testosterone Replacement [Last Updated On: January 23rd, 2018] [Originally Added On: January 9th, 2014]

- Transdermal testosterone replacement therapy - Video abstract 43475 - Video [Last Updated On: January 11th, 2014] [Originally Added On: January 11th, 2014]

- Testosterone Therapy - Bioidentical Testosterone Replacement ... [Last Updated On: December 21st, 2017] [Originally Added On: January 13th, 2014]

- Testosterone Side Effects from Testosterone Replacement ... [Last Updated On: December 8th, 2017] [Originally Added On: January 20th, 2014]

- MyAntiAgingMD The Leader In Testosterone Replacement Therapy - Video [Last Updated On: October 21st, 2020] [Originally Added On: January 29th, 2014]

- The benefits and risks of testosterone replacement therapy ... [Last Updated On: October 15th, 2020] [Originally Added On: February 6th, 2014]

- The Secret Female Hormone: How Testosterone Replacement Can Change Your Life [Last Updated On: October 28th, 2020] [Originally Added On: February 11th, 2014]

- Testosterone Replacement Therapy found to be linked to Heart Problems [Last Updated On: April 19th, 2025] [Originally Added On: February 25th, 2014]

- Serious Side Effects Linked to Testosterone Therapy [Last Updated On: September 17th, 2025] [Originally Added On: February 27th, 2014]

- Doctor Reveals How Getting off Testosterone Will Hurt Fighters on It [Last Updated On: November 27th, 2020] [Originally Added On: March 4th, 2014]

- California joins Nevada in banning testosterone replacement therapy [Last Updated On: October 4th, 2020] [Originally Added On: March 6th, 2014]

- Testosterone Replacement Therapy: How to Administer Expert TRT By John K. Crisler, DO - Video [Last Updated On: October 31st, 2020] [Originally Added On: March 9th, 2014]

- FGSW - Week 14 Weigh-In & Update: Going Back To The Endocrinologist - Video [Last Updated On: March 29th, 2014] [Originally Added On: March 29th, 2014]

- Drug Recall Attorney at Herrera Law Firm, Inc., Comments on Reported Link Between Testosterone Drugs and Heart Attack ... [Last Updated On: November 30th, 2020] [Originally Added On: April 2nd, 2014]

- FGSW - Testosterone Replacement Therapy Update 03.27.14: An Improvement?? - Video [Last Updated On: October 8th, 2020] [Originally Added On: April 2nd, 2014]

- FGSW Weekly Weigh In & Update 15 Still Working On Mobility 03 31 14 - Video [Last Updated On: October 15th, 2020] [Originally Added On: April 5th, 2014]

- Discover the risk of prostate cancer with testosterone replacement therapy - Video [Last Updated On: October 1st, 2020] [Originally Added On: April 5th, 2014]

- FGSW - Weekly Weigh In & Update 15: Still Working On Mobility 03.31.14 - Video [Last Updated On: October 3rd, 2020] [Originally Added On: April 7th, 2014]

- Testosterone Replacement Therapy - Video [Last Updated On: October 1st, 2020] [Originally Added On: April 12th, 2014]

- Reclaim Your Energy and Sex Drive | Testosterone ... [Last Updated On: April 21st, 2025] [Originally Added On: April 14th, 2014]

- Low Testosterone Claims: Options in a Growing Class Action Suit - Video [Last Updated On: November 25th, 2020] [Originally Added On: April 26th, 2014]

- Acrux falls 15% on sales warning [Last Updated On: September 28th, 2025] [Originally Added On: April 28th, 2014]

- Testosterone Replacement Therapy in Men - myVMC [Last Updated On: November 1st, 2020] [Originally Added On: April 30th, 2014]

- NJ-Based Law Firm Exploring Potential Legal Claims from Side Effects of Testosterone Replacement Therapy [Last Updated On: October 22nd, 2020] [Originally Added On: May 1st, 2014]

- Viewer Mail - Testosterone Replacement Therapy/TRT Not Natty, Balls Busted, etc. - Video [Last Updated On: October 2nd, 2020] [Originally Added On: May 4th, 2014]

- Seen At 11: Experts Urge Caution When Using Popular Hormone Replacement Therapy [Last Updated On: November 11th, 2020] [Originally Added On: May 10th, 2014]

- Are Low-T Drugs Putting Patients At High Risk? [Last Updated On: October 15th, 2020] [Originally Added On: May 10th, 2014]

- Seen At 11: Testosterone Replacement Therapy Could Come With Serious Side Effects - Video [Last Updated On: May 11th, 2014] [Originally Added On: May 11th, 2014]

- 1513 Hormone Replacement Therapy for Men - Video [Last Updated On: October 15th, 2020] [Originally Added On: June 13th, 2014]

Word Count: 642